Introduction In July, the Financial Conduct Authority (“FCA”) is expected to introduce its new “Consumer Duty” to increase the standard of care that regulated financial firms provide to their retail customers. The FCA has said that it hopes that the new duty will bring about a “significant shift” in standards in the banking sector, aided…

On 15 June 2022, the Foskett Panel announced fundamental changes to its approach to the Re-Review of D&C losses. The key change is, unquestionably, the Panel’s decision to introduce a new, interim, “Victim Status Decision” (“VSD”) and give all individual customers the option to exit the Re-Review immediately, before any MTD, in exchange for a…

In October 2020, the High Court in Bristol heard the case of Philipp v Barclays Bank UK plc[1]. The claimant, Mrs Philipp, had been the victim of an authorised push payment fraud (“APP Fraud”), whereby she had been duped by fraudsters in the UAE into transferring her lifesavings, some £700,000, into their accounts. The fraudsters…

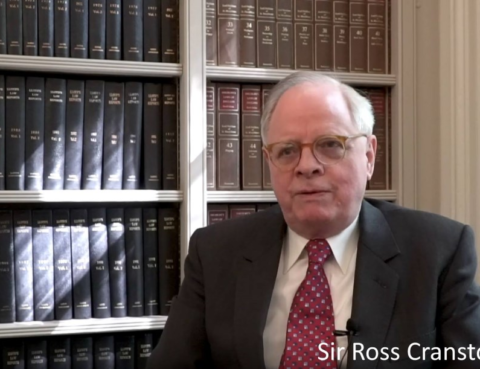

Background In April 2020, we reported that Sir Ross Cranston had released his second report on the HBOS Reading Fraud Customer Re-Review. Since then, Sir David Foskett has been appointed as the chair of an independent Re-Review Panel (the “Foskett Panel”) to reassess the direct and consequential (“D&C”) losses suffered by the customers affected by…

Background At the same time as publishing his second report into the HBOS Reading fraud Customer Re-Review, Sir Ross has also published a separate paper clarifying the recommendations he made in his first report, published in December 2019, regarding customers’ eligibility for inclusion in the Customer Review and the scope of Debt Relief offered by…

Background In December 2019, Sir Ross Cranston delivered his eagerly anticipated report into the heavily criticised Customer Review that was established by Lloyds Banking Group (the “Bank”) and overseen by Professor Griggs, in the wake of the HBOS Reading fraud scandal One of the key recommendations made by Sir Ross in his (first) report was…

Introduction At 12.00pm on 10 December 2019, Sir Ross Cranston delivered his eagerly anticipated report into the heavily criticised “Customer Review” that was established by Lloyds Banking Group (“LBG”) in the wake of HBOS criminal fraud scandal to deliver “fair” compensation to victims and which was overseen by Professor Russel Griggs, OBE (the “HBOS Customer…

Vneshprombank LLC v Georgy Bedzhamov and others [2019] EWCA Civ 1992 In the recent case of Vneshprombank LLC v Georgy Bedzhamov and others [2019] EWCA Civ 1992, the Court of Appeal has given welcome guidance on what amounts to “ordinary” in the context of the “ordinary living expenses” exception in a standard, non-proprietary, pre-judgment, freezing…

Cranston Review – Update: Sir Ross Cranston has signalled that he is now close to delivering his eagerly-awaited assurance review of the much-maligned “HBOS Reading Customer Review”, previously conducted by Lloyds Banking Group (“LBG”) under the oversight of Professor Russel Griggs (the “Griggs Review”). The Griggs Review, which closed on 7 May 2019, was heavily…

The Financial Conduct Authority’s (FCA) final notice in regard to the Halifax Bank of Scotland (HBOS) Reading fraud poses some serious questions for the FCA and the Dobbs Review, according to banking litigation solicitor Michael Sparkes. By DS Law The FCA Final Notice issued by the FCA on 20 June 2019 accompanied its fine of…